We've compiled a list of our frequently asked questions to help you navigate Card Controls.

{beginAccordion}

What are Card Controls?

Card Controls gives you complete control over your First Community debit and credit cards. You control when, where and how your cards can be used. Receive and act on real-time, instant alerts when transactions are processed. You can also set spend limits, block certain types of merchant or certain types of transactions, and even turn your card off and on.

What types of cards can I manage?

You can manage any open First Community debit or credit card, including Health Savings Debit cards as well as business debit and credit cards.

How do I get started with Card Controls?

Sign up for Card Controls from online banking or our mobile app. Look for Card Controls in the menu and accept the Terms and Conditions to get started.

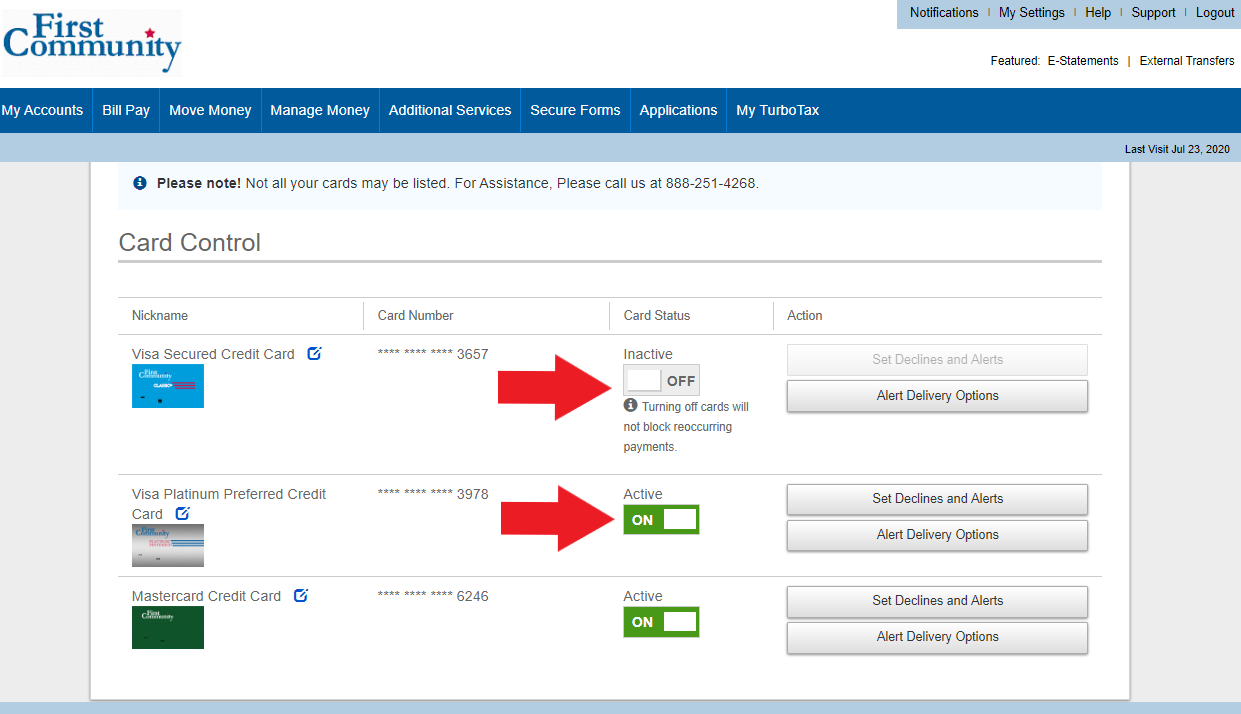

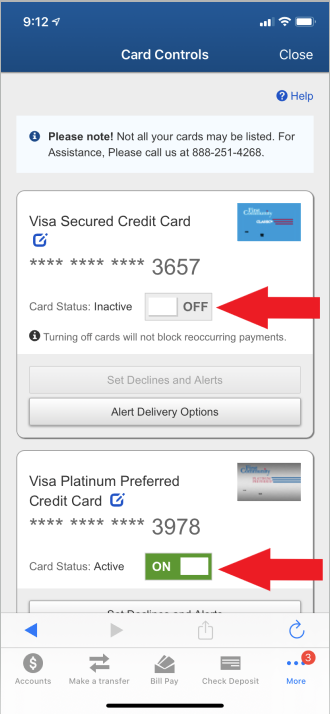

How do I turn my card OFF/ON?

Easy! You can manage your cards from online banking or from within our downloadable mobile app for iOS and Android. Just toggle the Card Status from ON (Active) to OFF (Inactive) and confirm, and you’re all set.

Card ON/OFF Mobile View:

Is there a fee?

There is never a fee for our service, but please note that standard text message and data rates assessed by your mobile carrier may apply if you opt in to receive alerts via text.

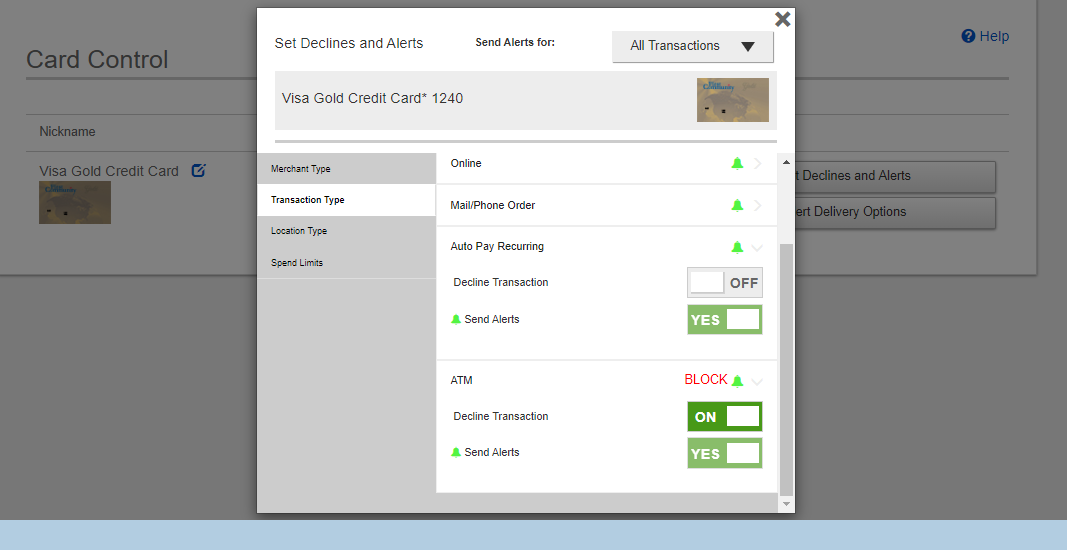

What is the difference between Alerts and Controls?

A Control recommends an action (denial) to the card processor based on the merchants, transaction types, location types and spend limits you set for that card. For example, say you want to be able to use your card for any type of in-store transaction at any merchant type, but you do not want your card used for Online or Mail/Phone order transactions, regardless of the merchant type, and not for any purchase over $1000.00.

An Alert notifies you based on the Controls you set. You can choose to get alerts every time your card is used, only for preferred transaction categories, or only when your card is attempted to be used for transaction types or merchants you have chosen to block. You can also choose to receive an alert any time a transaction occurs over a certain dollar amount.

What types of Alerts and Controls can I set/receive?

Controls: Card ON/OFF, Merchant Categories, Transaction Types, and Locations (ie. Block Foreign/International transactions), Spend Limits

Alerts: Receive Push Notifications, Text Messages and/or Email Notifications for any of your policies/controls, either individually or globally.

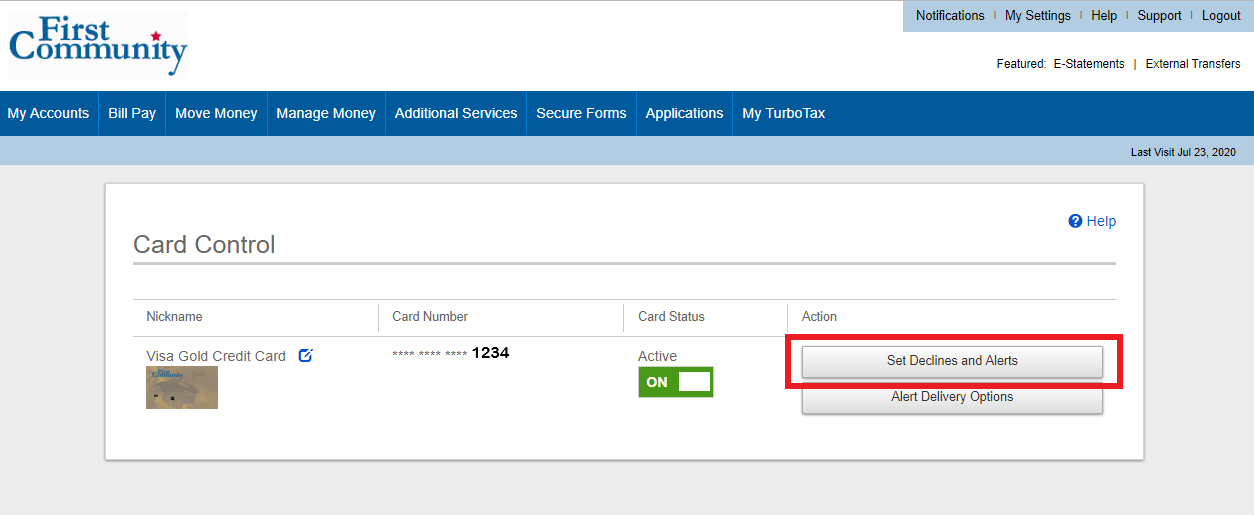

How do I set Alerts/Controls?

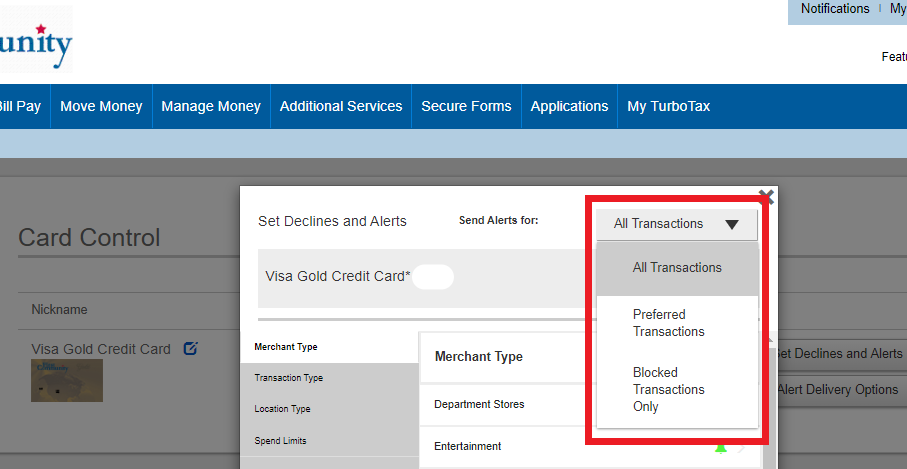

By default, alerts are enabled for All Transactions. If you do not wish to receive alerts for every transaction, you can change your preferences to send alerts for Preferred Transactions, or Blocked Transactions Only.

In what ways can I be notified of my Alerts?

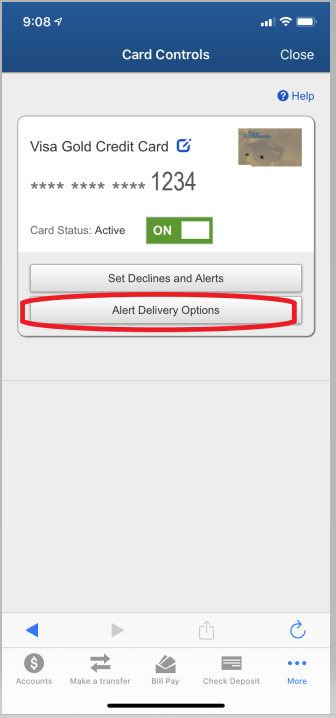

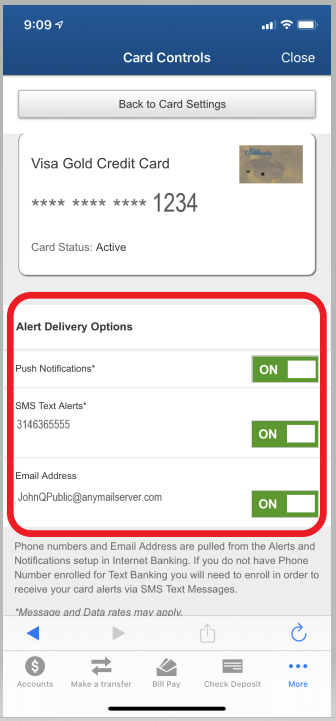

You can receive alerts via push notifications, text messages and/or emails. You can set your Alert Delivery Options up by clicking on the Alert Delivery Options link on the main Card Controls page and then toggling the ON/OFF buttons.

I’m not seeing the option for Push Notifications or SMS Text Alerts in the Alert Delivery Options. Why?

Please note that in order to receive push notification card alerts to your device, you must enable Notifications for the First Community mobile app in your device’s main Settings app.

Additionally, if you wish to receive card alerts via text message, you must sign up for sms/text message banking from the full online banking site under the Additional Services > Alert & Notifications section. For security reasons, you cannot sign up for sms/text message banking from within the mobile app.

I’ve enabled Push Notifications on my device for your app, but I’m still not seeing the option available to me in Card Controls.

If you’ve allowed all notifications for the FCCU mobile app, but still don’t see the option for Push Notifications, please try this:

- Open the FCCU mobile app

- Tap the MORE menu, then tap on Settings, then select Push Notifications

- Toggle ON one of the alerts (e.g.. Interact Messages)

- Go back thru Settings > More and tap on Card Controls

- Within Card Controls, tap on Alert Delivery Options for the applicable card(s), and you should now have the option to toggle on Push Notifications.

- If desired, go back to More > Settings > Push Notifications and toggle off the alert you turned on (however we highly recommend you leave Interact Messages enabled so that you can receive important information from us.)

If I turn my card Off, will my recurring transactions be blocked?

No, turning your card off will not stop any recurring payments that you have set up with merchants. You will need to contact each merchant directly to cancel recurring payments.

CardNav had the ability to tap on the transaction card to find out more details about the transaction. Can I still do that?

This first version of the Card Controls integrated application doesn’t support a ‘dive’ into the transaction details like it did on CardNav, but we do hope to be able to offer that in a future enhancement. In the meantime, pending and posted transaction details can be found in your checking account history on the app. And, you can always contact us for more information on any transaction alert.

Can I set up alerts for each card on the account to go to different phone numbers?

Yes, you can set up two phone numbers for SMS text message delivery of your alerts. To add an additional phone number, navigate to Additional Services > Alerts & Notifications section of desktop online banking (not the mobile app) and click to add a second number. Once you enable it for text message delivery, go to Card Controls, click on Alert Delivery Options for the card(s) you wish to manage, and then toggle on the appropriate phone number you wish to get alerts for that card.

Can I view and manage cards on accounts that are linked to my primary account in online banking?

In order for a card to be managed using Card Controls, it must be directly associated to the primary account number that you login with; cards associated to accounts that are linked together for online/mobile access cannot be managed from another account. You will need to login directly to the account that the credit/debit card is associated with in order to use card controls. The ability to manage cards associated to linked accounts may be possible in a future enhancement.

Why can’t I add my own cards from other accounts?

Unfortunately, this is not an option at this time. You can use Card Controls on any First Community credit or debit card, but those controls and alerts will need to be managed from a set of login credentials that are specific to the account number associated with the sixteen-digit card number.

What should I do if my card is lost/stolen?

You should immediately set your Card Status to OFF to block any potential use, and then call us at 800.767.8880 so we can close your card and get you a new one issued.

When will my card show up in Card Controls?

Newly generated card numbers should be available to manage the next business day after we create the card record.

Can I notify First Community of my travel plans using Card Controls?

Not at this time, but you can submit a travel notification from behind online banking or by calling us at 800.767.8880

{endAccordion}