What is a Credit Score & How Does it Work?

02/14/2023

By: Brady

There is a lot of pressure to have a good credit score, so it is essential to ensure you have correct information on a credit score and how it works.

A Credit Score is a ranking between 300 and 850 that helps credit lenders understand how likely you are to be financially responsible. Knowing how your credit score works is just as important as knowing what it is, so we have broken it down for you!

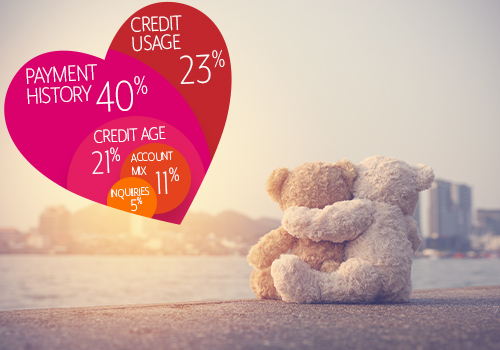

5% Recent Activity/Inquiries

Five percent of your credit score is based on how often credit lenders look at your score. This is considered a hard credit check, and if you are not careful, it can add up fast. Hard credit checks are the only credit checking form that negatively affects your credit score.*

There are ways to check your credit score without a negative impact! At First Community, we have a tool within online banking that calculates your credit score (provided by TransUnion and is based on the VantageScore® 3.0 model). This allows you to easily see your credit score and how it is affected without a negative impact!

11% Account Mix

Another important aspect of your credit score is your Account Mix which is responsible for 11% of your credit score. This is the number of different accounts you have, and having a proven history of managing more than one line of credit effectively shows credit lenders that you can handle the responsibility of opening a new account.

21% Credit Age

The third largest attribute to your credit score is your Credit Age. Credit Age is the average length of your credit history. It is calculated by taking your oldest and newest account (by months), adding them together, and dividing them by the number of accounts that you have open.

23% Credit Usage

The second largest contributor to your credit score is how much revolving credit you use. Revolving credit is a line of credit that remains available over time, and that is paid off as you go (i.e., credit card, home equity line of credit). Keeping credit usage under 30% is usually a good rule of thumb when you want to keep your credit score high.**

40% Payment History

The biggest factor that contributes to your credit score is your payment history. This number reflects whether or not you pay bills on time, how often you miss payments, how many days past the due date, and how many recent payments you have missed altogether. Payments made over 30 days late will typically be reported by your lender and lower your credit scores. However, if you can pay the bill before the 30 days, it may mean that your score is free from negative effects.*** The longer your credit age shows a healthy payment history, the less a late payment affects your score, if at all. Paying your bills on time is still important each month!****

Credit scores don’t have to be confusing, and with a basic understanding of what makes them up, you can stay on top of your credit score and have the best opportunities possible!

*“What is a Credit Score” TransUnion

**“What Should My Credit Card Utilization Be?” Experian.com

***“How Your Credit Score is Calculated” WellsFargo

****“What is Payment History” Myfico.com

Content is accurate at the time of blog posting and is subject to change.